The husband would need the wife's consent and signature.

Besides the medical issue I also think the contract has to be signed before the insurance agent.

I think it depends on the state. I recently read that in GA, the consent of the spouse is not required-- provided the husband has an insurable interest in their life. This means that you will suffer a financial loss in the event of the death of your spouse.

In Utah, I believe Kouri Richins purchased life insurance for her husband by forging his signature.

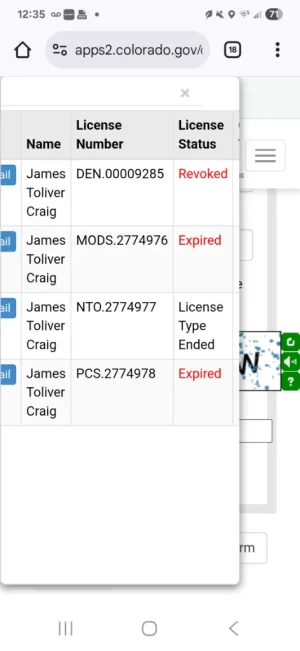

Specific to Colorado, and per AI:

- Consent of the Insured: Colorado law explicitly states that a policy on the life of an individual (other than noncontributory group life insurance) cannot be effected unless the insured individual, having legal capacity to contract, applies for or consents in writing to the policy and its terms. This means your wife would need to be aware of and agree to the policy being taken out on her life.

And here's an example of "noncontributory group life insurance" in Colorado that was paid on a spouse: Chris Watts received life/AD&D insurance as an employee benefit from Anadarko Petroleum Corporation.

Under the policy, the employee was the "primary" insured but the employee's spouse and children were also deemed "covered" under this policy if the employee elected to allocate a percentage of their policy benefit (principal sum) to them.

It's best explained that if the employee (i.e., primary) was first to die in a covered event, 100% of the principal sum was paid to his named beneficiary, his life benefit was paid out in full, and the employee's benefits terminated.

In the Watts case, his wife and two children were the first to die-- in what was deemed a covered event, so his policy paid the percentages of the principal sum he'd previously assigned to each. According to Colorado Law, this only form of life insurance that would not require the individual's consent to obtain insurance for them-- including a spouse.

GA Spouse